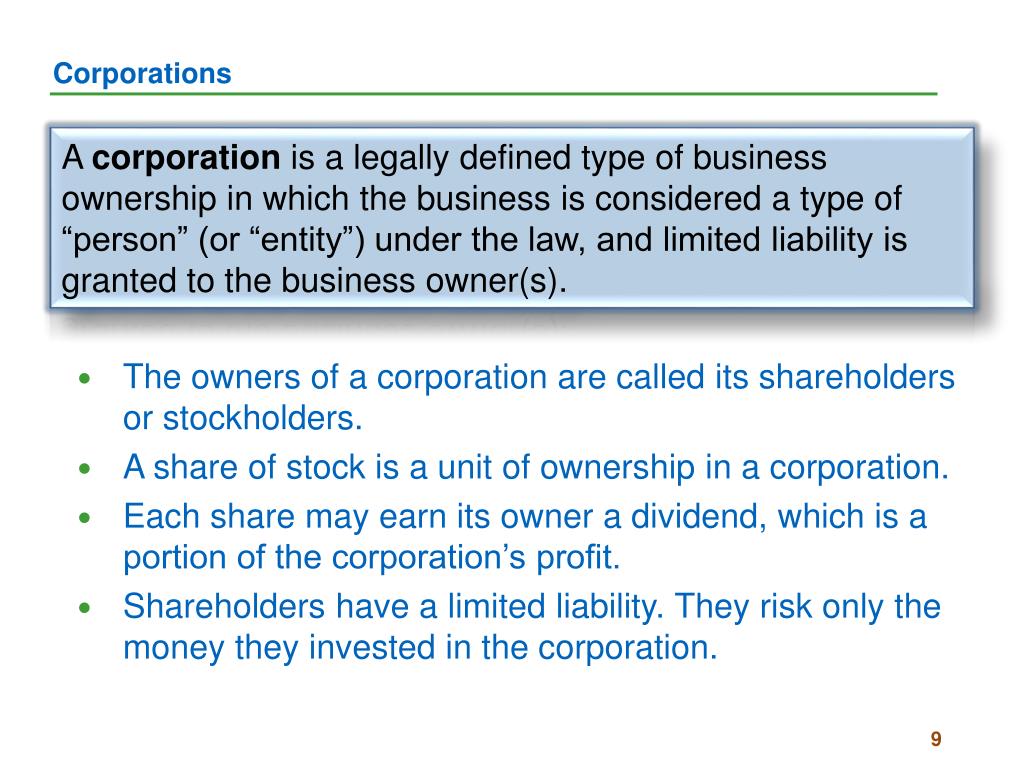

In the landscape of modern commerce, service corporations stand as essential entities, managing a significant section of economic tasks worldwide. A business company is a legal entity that is different and distinctive from its proprietors, who are shareholders. This separation guards investors from individual obligation for the corporation's responsibilities and financial obligations, an essential benefit that motivates investment. Corporations can becoming part of contracts, filing a claim against and being sued, having properties, and paying tax obligations. They are produced under the legislations of each state and should abide by numerous statutes that control their framework and operations. The corporate structure is hierarchical, usually including shareholders, a board of supervisors, and officers. Shareholders invest resources and possess the firm however do not manage day-to-day operations; instead, they elect a board of supervisors who manage the wider critical instructions and select officers who handle day-to-day events.

The formation of a firm involves a number of steps, including the declaring of Articles of Consolidation with the state, which lay out the main objective of the organization, its principal workplace, and the number and kind of authorized shares. As companies grow, they might release stock to elevate resources, thereby watering down possession but acquiring the funds needed for development and operations. This ability to raise huge amounts of capital makes them particularly attracting large services. Companies likewise benefit from perpetual existence, indicating they remain to exist regardless of changes in possession or administration. This connection provides security to business atmosphere and promotes long-lasting planning and financial investment. The impact of companies expands beyond economic dimensions; they also wield significant social and political power, often playing critical duties in job creation, governance, and advancement. Understanding the mechanics and implications of corporate framework is vital for stakeholders varying from capitalists to policymakers.

Understanding the Structure and Function of Company Corporations

A company corporation is a distinctive legal entity, separate from its owners, which is developed to carry out industrial activities with the goal of generating revenue. This structure permits the corporation to possess assets, incur obligations, and become part of contracts under its business name, offering a considerable level of defense to its shareholders from individual obligation for the debts and commitments of the company. Usually, a company is had by shareholders who invest resources into business for shares standing for partial ownership. These investors have actually limited liability, implying their individual assets are safeguarded; they are just in danger of losing their investment in the firm. The governance of a company is normally looked after by a board of supervisors, chosen by the investors. This board makes significant decisions and establishes lasting policies, while daily procedures are taken care of by supervisors and police officers selected by the board. This ordered structure aids in organizing the responsibilities and powers within the firm, making sure a balance of power amongst various levels of stakeholders. One more essential feature of firms is their capacity to raise considerable amounts of funding through the sale of shares to the general public, a process promoted by stock market. This attribute not just fuels development and technical improvements however likewise contributes to the general economic development by producing tasks and cultivating development. Hence, companies play a critical duty in the contemporary economy, driving ahead markets and affecting the economic landscape substantially.

Company Framework and Governance

In the world of service, understanding the framework of corporate framework and administration is important for both budding business owners and seasoned investors. At its core, a corporation is a lawful entity different from its owners, with the ability of owning residential property, becoming part of contracts, and being accountable in lawsuits independently of those who own it. This splitting up is essential as it shields individual possessions from company responsibilities and gives a structured strategy to management and operational responsibilities. Company governance, the system of policies, practices, and procedures through which a firm is directed and regulated, plays a fundamental role in maintaining the integrity and performance of business procedures. It includes balancing the passions of a firm's several stakeholders, such as shareholders, management, consumers, providers, sponsors, federal government, and the area. While the specifics can differ widely across various jurisdictions, the general framework generally includes a board of supervisors accountable for making significant choices and overseeing the basic program of the company, and police officers who take care of the day-to-day procedures. Reliable governance calls for a durable set of plans and methods that make certain the accountability of people within the corporation by making use of distinct systems to manage the intricate interaction between the various stakeholders. These systems usually include implied and specific contracts, business hierarchies, and processes designed to provide a structure for achieving the operational and strategic objectives of the business. Thus, the design of business governance is not just an institutional information; it is main to the effectiveness and the honest compass of the organization, affecting everything from company culture to bottom-line performance.

Secret Frameworks and Models of Organization Firms

Organization companies come in various structures and versions, each tailored to fulfill specific objectives, functional requirements, and tactical ambitions of business proprietors and stakeholders. One basic structure is the C company, a popular selection amongst organizations due to its ability to draw in capitalists via the issuance of openly traded securities. incorporated examples provide limited obligation to their owners, indicating that the individual possessions of shareholders are secured from claims against business. They are subject to double tax-- once at the business level and once again at the specific degree on rewards. Unlike their website , S firms prevent this double taxation by passing company revenue, losses, deductions, and credit ratings through to their shareholders for federal tax functions. One more design, the Minimal Responsibility Business (LLC), incorporates the obligation security of a company with the tax effectiveness and functional flexibility of a partnership. The LLC is preferred by little to medium-sized services for its simpleness and less rigid functional requirements contrasted to standard corporations. Internationally, company frameworks can vary considerably. For circumstances, in Germany, the GmbH (Gesellschaft mit beschränkter Haftung) supplies a comparable responsibility defense to that of an LLC but with various governing and tax implications. Moreover, companies are additionally checking out ingenious versions like the Advantage Firm, which not only seeks to generate profit yet likewise to create a positive effect on society and the setting. This design is legally equipped to pursue broader goals past the financial interests of shareholders, a move that is becoming progressively prominent with socially conscious entrepreneurs. Each of these corporate structures and models serves different organization purposes and includes its special collection of legal, tax obligation, and functional ramifications that must be very carefully considered when intending an organization. Understanding these options and the thorough subtleties that each model presents is vital for making educated choices that line up with a business's long-lasting calculated goals.

Strategic Effects of Service Firm Structures

The architectural framework of an organization corporation plays an essential role in determining its operational effectiveness and calculated versatility in a dynamic market atmosphere. Comprehending the various kinds of company structures-- such as C companies, S companies, Restricted Liability Firms (LLC), and collaborations-- offers a structure for entrepreneur to align their functional objectives with the most useful lawful and tax obligation implications. love it , for instance, are dealt with as separate tax entities completely, causing what is referred to as dual taxes-- first on the firm's revenues and once again on the rewards paid to investors. Nevertheless, this framework permits for possibly endless development with the sale of supplies, which can be a crucial benefit for companies aiming to increase quickly. In comparison, S corporations gain from pass-through taxes, where losses and profits are straight reported on the owner's personal revenue, preventing double tax and fitting smaller sized businesses that go for simpleness in their tax obligation handling. LLCs use a lot more adaptability, combining the limited obligation features of a corporation with the tax efficiencies and functional versatility of a collaboration. The option of service structure influences not just tax obligation considerations but additionally influences exactly how organizations are perceived by financiers, prospective companions, and markets. Choices relating to business framework must for that reason be made with a comprehensive understanding of both temporary advantages and long-lasting critical objectives, ensuring that the chosen framework sustains sustainable growth and functional agility. As markets proceed to advance and new legal policies come right into play, the versatility provided by a proper company structure can be a considerable component of a firm's success and longevity.